In the ever-evolving landscape of insurance, technology plays a pivotal role in transforming how claims are processed, assessed, and resolved. Among the innovative tools reshaping the industry, Matterport 3D tours stand out as a game-changer for insurance claims. This cutting-edge technology offers a comprehensive, immersive, and accurate way to document and assess property damage remotely. This blog delves into the revolutionary impact of Matterport 3D tours on the insurance sector, providing fresh insights and advice on leveraging this technology to streamline claims, enhance accuracy, and improve customer satisfaction.

The Matterport Advantage in Insurance Claims

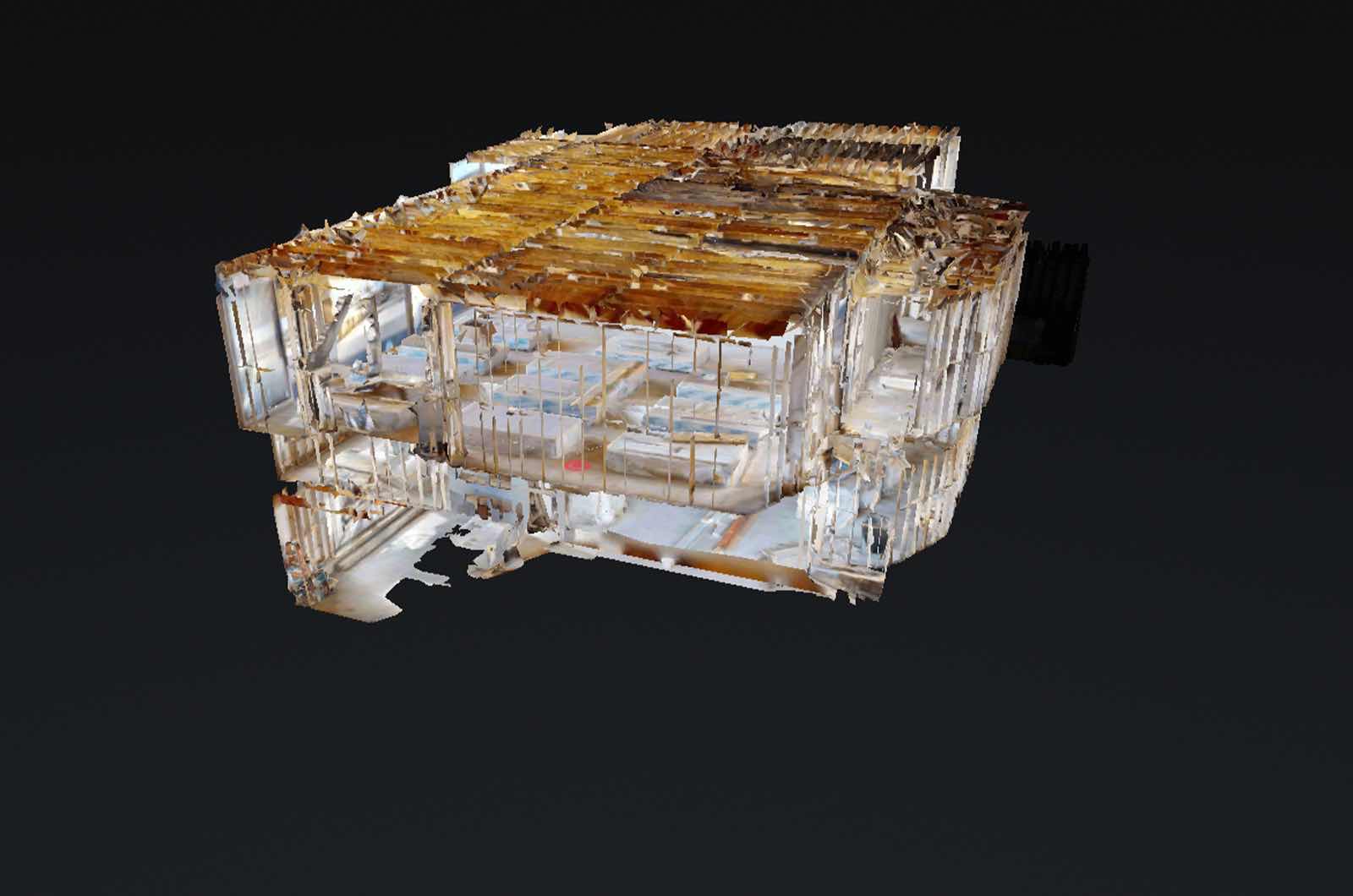

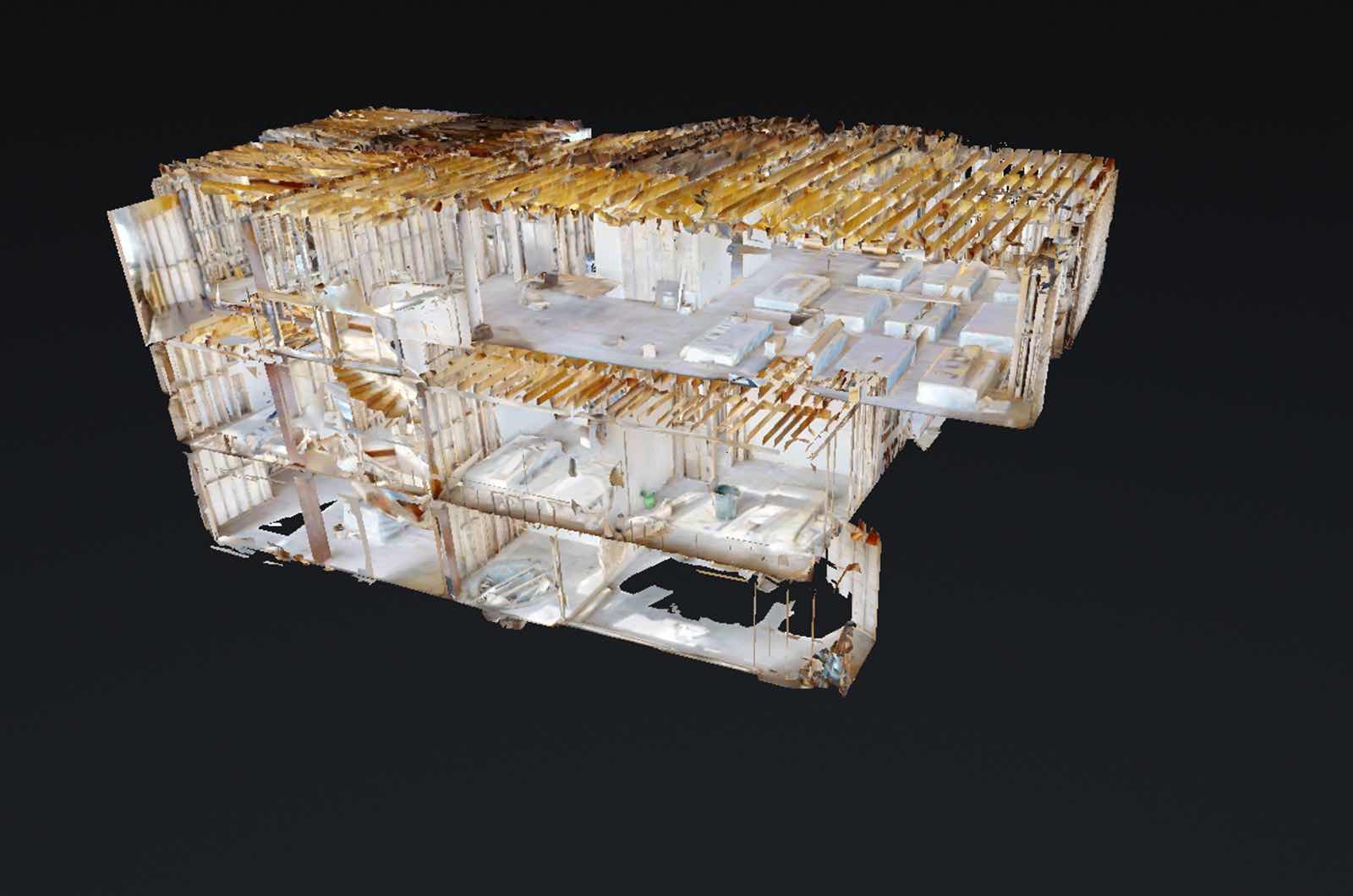

Matterport technology captures detailed three-dimensional representations of spaces, creating virtual tours that users can navigate as if they were physically present. For insurance companies, this means unprecedented access to accurate, detailed visual documentation of properties pre- and post-claim event. Here’s how Matterport 3D tours are setting new standards in the insurance industry:

Enhanced Documentation for Accurate Assessments

Traditional methods of documenting claims through photos and videos often fall short in capturing the full extent of damage. Matterport 3D tours allow adjusters to virtually walk through the property, examining the damage from every angle and ensuring nothing is overlooked. This level of detail supports more accurate assessments and fair settlements.

Streamlining the Claims Process

Matterport technology significantly speeds up the claims process. Insurers can conduct virtual inspections without the need for physical site visits, reducing the time from claim filing to resolution. This not only saves costs but also enhances customer satisfaction by providing quicker outcomes.

Fraud Reduction

The comprehensive nature of 3D tours makes it more difficult for claimants to exaggerate or fabricate damages. The technology captures the condition of the property in intricate detail, providing a timestamped, indisputable record that insurers can reference, thus mitigating the risk of fraudulent claims.

Risk Management and Prevention

Beyond claims processing, Matterport 3D tours offer value in risk assessment and management. Insurers can analyze the detailed imagery to identify potential hazards or maintenance issues that could lead to future claims, advising policyholders on preventive measures.

Innovative Applications of Matterport 3D Tours in Insurance

While the benefits of Matterport technology in claims processing are clear, its potential applications continue to expand, offering new ways to improve the insurance landscape:

Pre-Loss Documentation

Encouraging policyholders to create Matterport 3D tours of their properties as part of the policy initiation process provides invaluable baseline documentation. In the event of a claim, insurers can compare pre- and post-loss conditions, streamlining claim processing and ensuring accurate compensation.

Disaster Response and Recovery

In the aftermath of natural disasters, accessing affected areas can be challenging. Matterport 3D tours enable insurers to conduct remote assessments, accelerating the claims process for multiple policyholders simultaneously and facilitating quicker recovery for affected communities.

Training and Education

Matterport technology offers a unique tool for training insurance adjusters. Virtual tours of damaged properties can be used as educational resources, helping adjusters learn to identify and evaluate different types of damage without the need to visit a site physically.

Customer Engagement and Transparency

By sharing Matterport 3D tours with policyholders, insurers can foster a more transparent claims process. Customers can virtually accompany adjusters during the assessment, gaining a better understanding of the damage evaluation and settlement rationale.

Conclusion

Matterport 3D tours are redefining the insurance claims process, offering a blend of efficiency, accuracy, and transparency that was previously unattainable. This technology not only streamlines claim assessments and mitigates fraud but also enhances customer satisfaction by providing a clearer, more engaging claims experience. As we look to the future, the integration of Matterport 3D tours in insurance practices is poised to become a standard, underscoring the industry’s commitment to innovation and customer service excellence. Insurers who embrace this technology will not only optimize their operations but also strengthen their relationships with policyholders, setting a new benchmark in the competitive landscape of insurance.