The insurance industry is constantly seeking innovative ways to streamline processes and improve accuracy. Traditional methods of assessing damage, relying heavily on photos and in-person inspections, often prove time-consuming, expensive, and sometimes inaccurate.

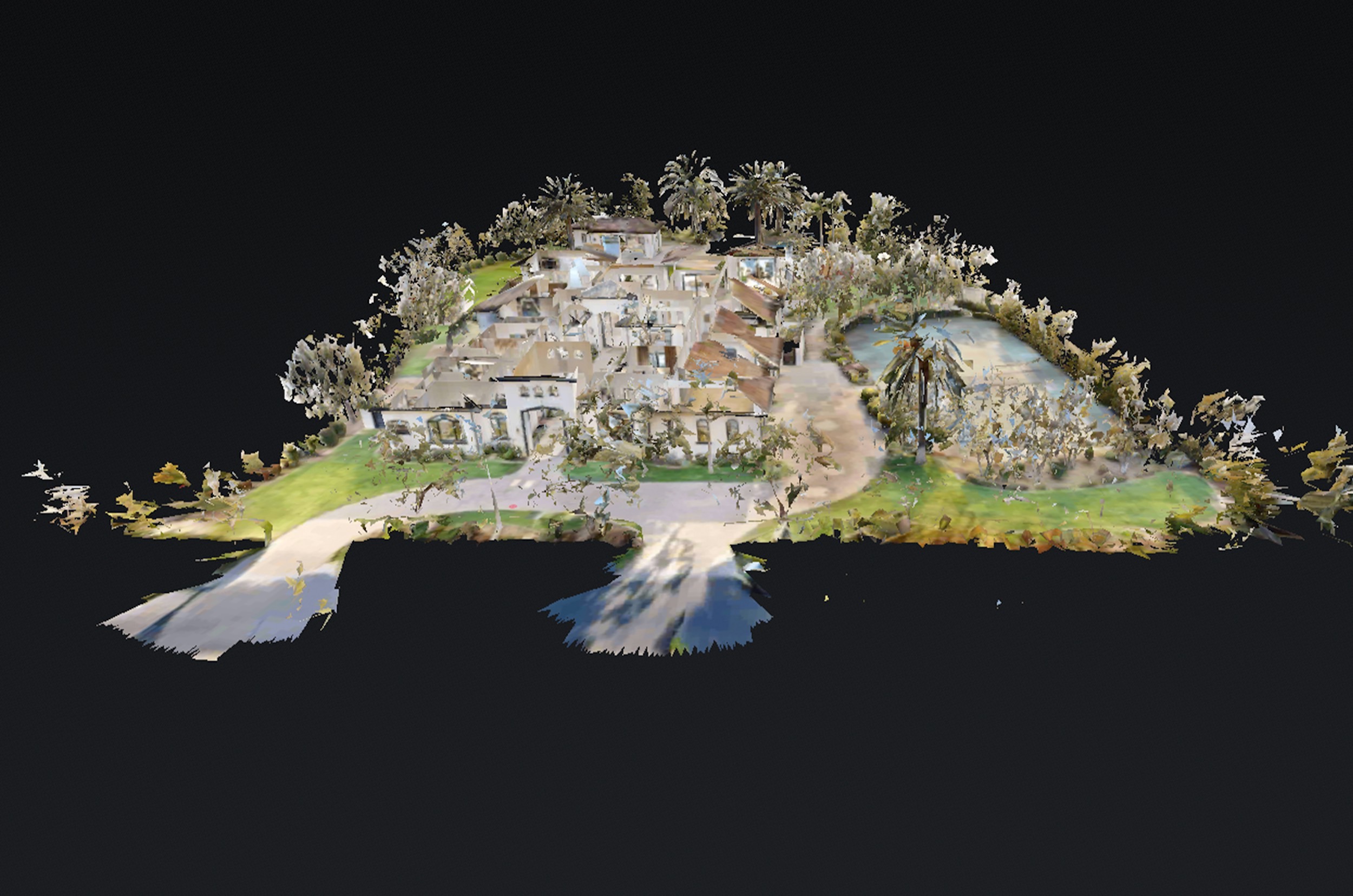

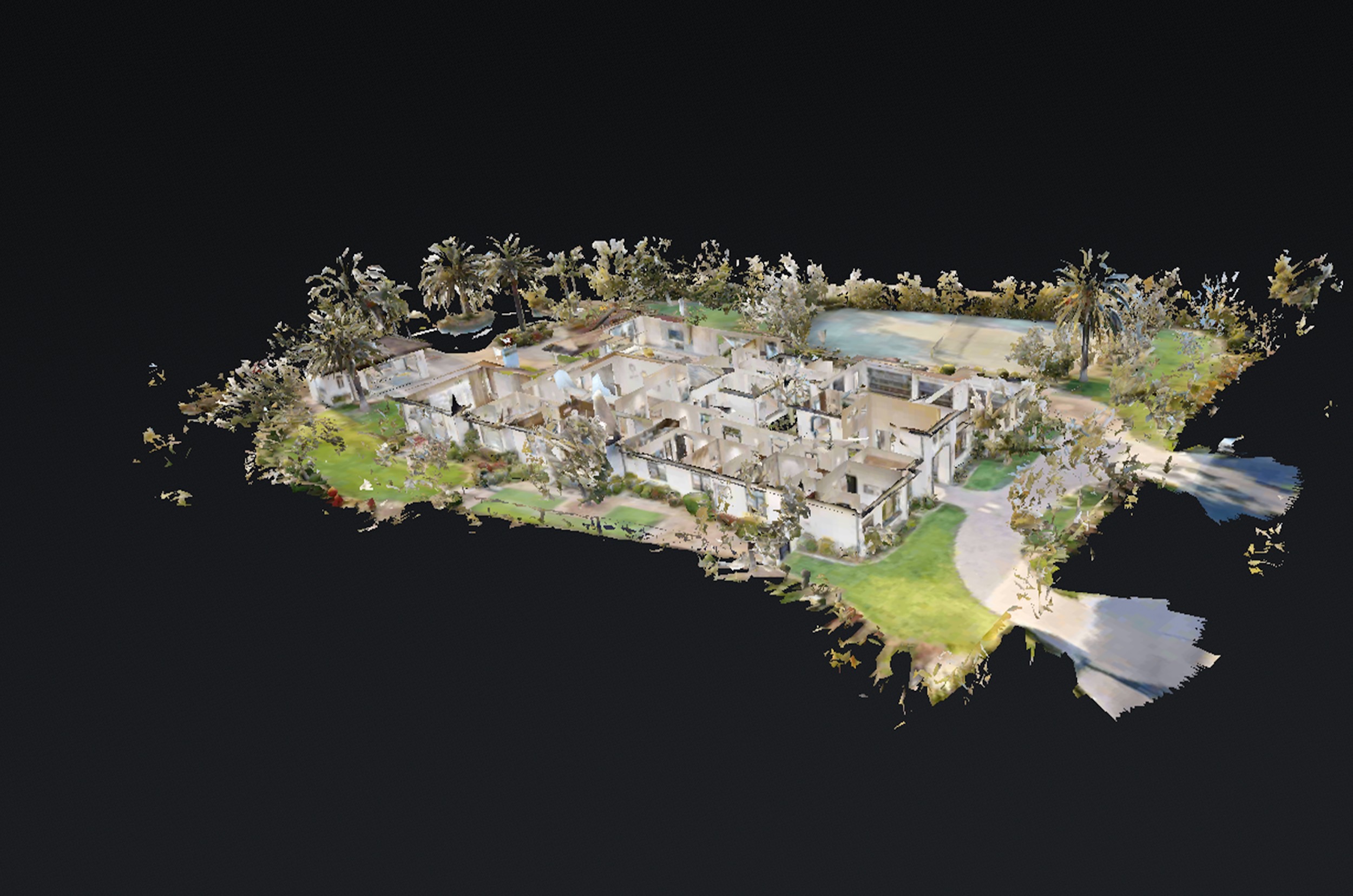

Enter Matterport, a cutting-edge 3D tour technology that’s transforming how insurance companies handle claims. Matterport creates immersive, interactive 3D tour models of properties, offering a level of detail and accessibility unmatched by traditional methods. This blog post explores the significant benefits of utilizing Matterport 3D tours for insurance purposes.

Matterport 3D Tours: Multifaceted For Insurance Claims

Matterport’s impact on insurance is multifaceted. Firstly, it significantly accelerates the claims process. Instead of scheduling potentially multiple site visits, adjusters can remotely assess the damage using the 3D tour model. This saves valuable time and resources, allowing for quicker payouts and increased client satisfaction.

The interactive nature of the tour allows adjusters to meticulously examine every corner of a property, zooming in on specific areas of damage and taking precise measurements without being physically present. This detailed view minimizes the risk of overlooking crucial details, leading to more accurate assessments.

Matterport 3D Tours: Accuracy of Damage Assessments

Secondly, Matterport 3D tours help enhance the accuracy of damage assessments. The 3D tour models provide a comprehensive, objective record of the property’s pre- and post-incident condition. This eliminates discrepancies and potential disputes that can arise from conflicting accounts or limited photographic evidence.

The ability to measure distances, angles, and volumes precisely allows for a more accurate estimation of repair costs, reducing the likelihood of under- or over-estimation. This level of detail is invaluable in complex claims involving significant damage.

Matterport 3D Tours: Great For Improving Communication

Furthermore, Matterport improves communication and transparency between insurers, adjusters, and policyholders. Sharing the 3D model allows all parties to have a clear understanding of the damage, fostering collaboration and trust. This is particularly beneficial in cases where the policyholder is unable to be present for an in-person inspection. The Matterport 3D tour provides a virtual walkthrough, allowing the policyholder to see exactly what the adjuster sees, thus reducing misunderstandings and potential disputes.

The accessibility of the 3D model also allows for easier collaboration between different teams within the insurance company, improving internal efficiency.Finally, the use of Matterport contributes to a safer working environment.

By reducing the need for in-person visits to potentially hazardous locations, it minimizes risks for adjusters and other personnel. This is particularly important in cases involving structural damage or hazardous materials.

Conclusion

Matterport 3D tours represent a significant advancement in insurance claim management. By offering speed, accuracy, improved communication, and enhanced safety, Matterport provides a compelling solution for insurance companies looking to modernize their operations and improve client satisfaction.

The technology’s ability to provide a detailed, objective record of property damage is invaluable, ultimately leading to a more efficient and equitable claims process for all involved. As the technology continues to evolve, its integration into the insurance industry is likely to become even more widespread, setting a new standard for claim handling in the years to come.