Filing an insurance claim after a property damage event can be a stressful and complex process. Gathering accurate documentation of the damage is crucial for a smooth and successful claim. Traditional methods, such as photographs and written descriptions, can often fall short in capturing the full extent of the damage.

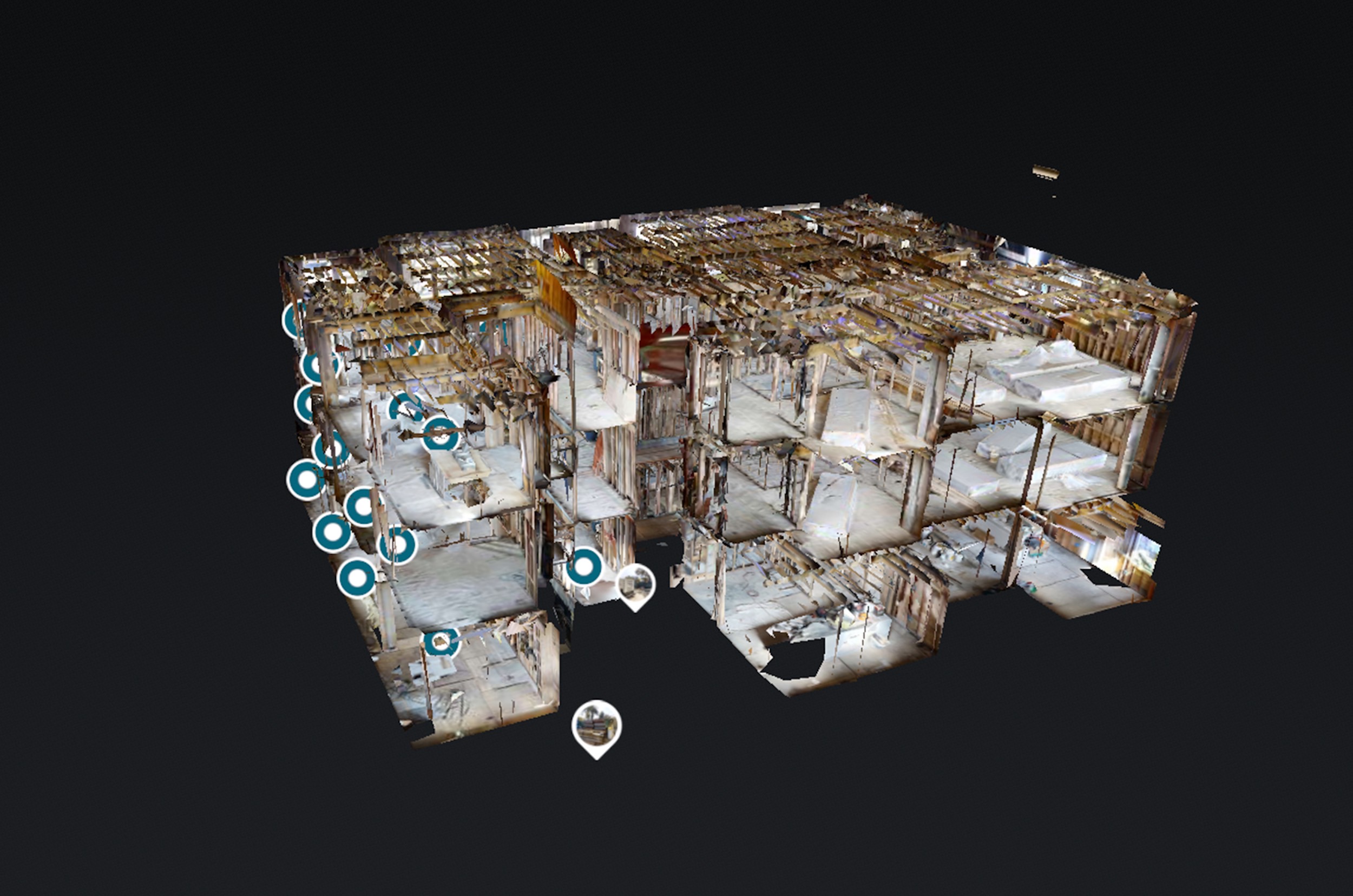

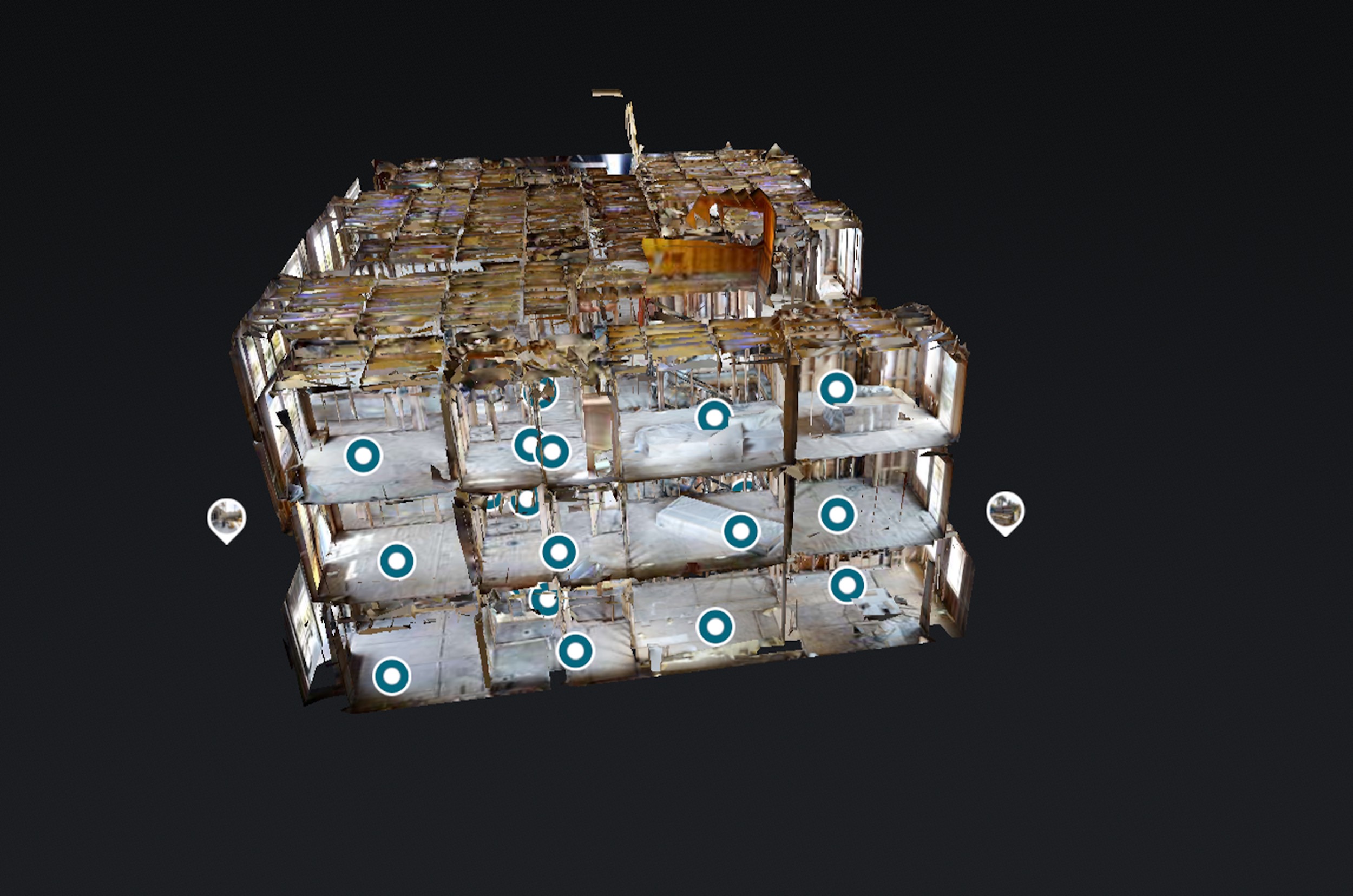

This is where Matterport 3D tours step in, offering a revolutionary way to document property damage for insurance claims. This blog explores the benefits of using Matterport 3D tours to streamline and strengthen your insurance claim process.

Beyond Static Images: The Power of 3D

Matterport creates immersive, interactive 3D models of your property. Unlike static photographs, these tours allow adjusters to virtually “walk through” the damaged area, experiencing the extent of the damage from multiple perspectives. This detailed visualization significantly improves the accuracy and comprehensiveness of the claim documentation.

Key Benefits for Insurance Claims:

- Comprehensive Documentation: Matterport 3D tours capture every detail of the damage, including hard-to-reach areas or subtle damage that might be missed in traditional photos. This thorough documentation leaves no room for ambiguity or dispute.

- Enhanced Communication: The interactive nature of the tour allows adjusters to easily understand the scope of the damage, accelerating the claims process. It eliminates the need for multiple site visits, saving time and resources for both the insured and the insurance company.

- Objective Evidence: The 3D model provides objective evidence of the damage, minimizing the potential for disputes or disagreements about the extent of the damage. This strengthens your claim and increases the likelihood of a fair settlement.

- Improved Accuracy: The detailed measurements and spatial information provided by Matterport enhance the accuracy of the damage assessment. This ensures that the repair estimates are precise and avoid under- or overestimation.

- Reduced Claim Disputes: The clear and comprehensive documentation provided by Matterport significantly reduces the potential for claim disputes. This leads to faster claim resolution and a more positive experience for the insured.

- Pre-Loss Documentation: Proactive use of Matterport to document your property before any damage occurs provides a valuable baseline for comparison. This is especially helpful in cases of significant damage or where the pre-damage condition is difficult to recall.

How to Use Matterport for Insurance Claims:

- Engage a Certified Matterport Pro: Hiring a professional Matterport 3D tour photographer ensures high-quality scans and accurate representation of the damage.

- Capture the Damage: The Matterport Pro will create a detailed 3D model of the damaged areas, capturing all relevant details.

- Share the Tour: The tour can be easily shared with your insurance adjuster via a secure link, allowing them to access it remotely.

- Support Your Claim: Use the Matterport tour as supporting evidence in your claim, highlighting the damage and supporting your repair estimates.

Conclusion

In today’s digital age, traditional methods of documenting property damage are becoming outdated. Matterport 3D tours offer a superior alternative, providing comprehensive, accurate, and easily accessible documentation for insurance claims.

By utilizing this technology, you can significantly improve the efficiency and success of your claim process, reducing stress and ensuring a fair settlement. Investing in a Matterport 3D tour after a property damage event is a smart move that can save you time, money, and frustration. Consider it a valuable tool in your arsenal for navigating the complexities of insurance claims.